Selling SME IPO shares in Angel Broking involves a different method compared to regular shares. Below, we provide a quick overview of the how to sell sme ipo shares in angel broking, accompanied by a helpful visual guide.

Table of Contents

Steps

- Access the Sell Option:

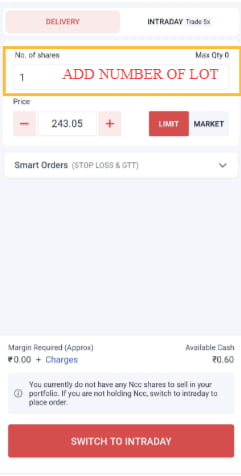

- Upon clicking the ‘Sell’ option, you’ll encounter a layout similar to the one pictured above.

- Specify Lot Quantity:

- In the ‘Number of Shares’ field, it’s crucial to enter the lot quantity instead of the actual number of shares for SME IPO shares. This marks a key distinction between selling SME IPO shares and regular IPO shares.

For instance, if you applied for 1 lot of SME IPO with an allotment of 1200 shares per lot, you should input ‘1’ in the ‘Number of Shares’ textbox, not ‘1200’.

By following these steps, you can seamlessly navigate through the process of selling SME IPO shares on Angel Broking. This adjustment in the method ensures clarity and precision in your transactions. Happy trading!

To read more news related to business, finance, and sports, click here.

In this post, I have shared all the steps about selling SME IPO shares in Angel Broking based on my experience with Angel applications only. This may have worked in other applications as well.

FAQs

First, open the Angel One application, then click on IPO, and select the IPO that you want to sell.

1.Access the Sell Option: Upon clicking the ‘Sell’ option, you’ll encounter a layout similar to the one pictured above.

2.Specify Lot Quantity: In the ‘Number of Shares’ field, it’s crucial to enter the lot quantity instead of the actual number of shares for SME IPO shares. This marks a key distinction between selling SME IPO shares and regular IPO shares.

Zerodha,

Angel One,

Motilal Oswal etc.

After the Listing

Small and Medium Enterprises Initial Public Offerings (SME IPO)